**Navigating the Harborne Q1 Property Market: A Comprehensive Analysis**

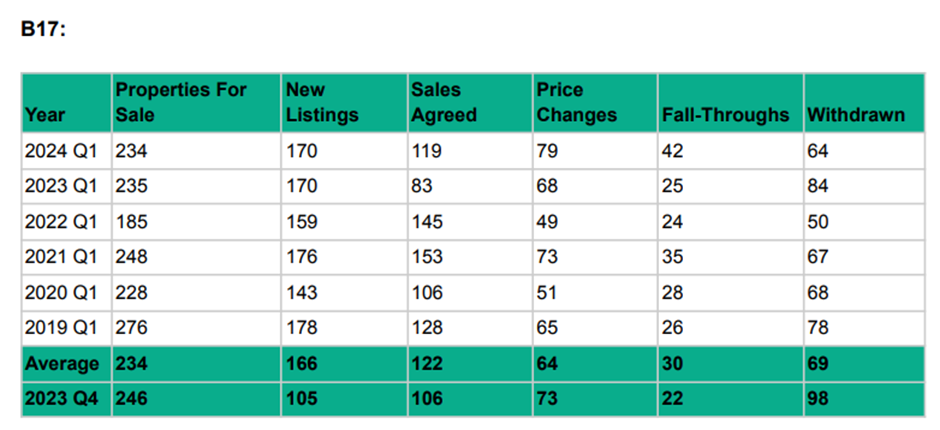

Delving into the Harborne property market for the first quarter of 2024 produces some interesting insights:

**1. Market Stability Amidst Consistent availability:**

The number of properties for sale remains steady, mirroring recent years. This stability defies predictions of a surge in forced sellers that could trigger significant price declines. The consistent inventory levels suggest a balanced market with sustained seller confidence. Additionally, this scenario hints at a potential shortage of properties for purchasers, fostering pent-up demand and providing further support to prices.

**2. Steady New Listings and Surge in Sales Agreements:**

New listings have maintained a steady pace, while sales agreements witnessed a notable uptick of 43.37% compared to Q1 2023, now aligning closely with the six-year average. This consistency underscores market stability and instills confidence among stakeholders. The surge in sales agreements reflects heightened buyer activity, contributing to a dynamic marketplace.

**3. Understanding Fall-Throughs Amid Increased Sales:**

With increased sales agreements, a rise in fall-throughs is expected. However, this trend is a natural consequence of heightened market activity and does not necessarily indicate underlying instability. Instead, it signifies a robust transactional environment with evolving dynamics.

**4. Adjustments in Pricing Strategies and Market Response:**

**4. Adjustments in Pricing Strategies and Market Response:**

Price changes are trending upwards, accompanied by a decrease in withdrawals from the market. These shifts suggest that sellers and agents are adapting to market conditions, resulting in more sales agreements and fewer properties withdrawing from the market. This adaptability enhances market fluidity and supports smoother transactions.

**5. Emphasizing Pricing and Marketing Alignment:**

In conclusion, properties priced and marketed correctly are witnessing successful transactions, while those deviating from market realities are adjusting their asking prices to facilitate sales. This underscores the importance of informed pricing and marketing strategies in navigating the market effectively.

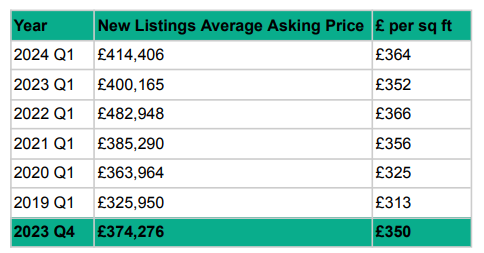

**Insights from Asking Price per Square Foot:** - **New Listings:** The average asking price per square foot for new listings in Q1 2024 has improved from Q1 2023, nearly returning to the levels observed in Q1 2022. This resurgence in asking prices reflects a gradual return of seller confidence to the market.

- **New Listings:** The average asking price per square foot for new listings in Q1 2024 has improved from Q1 2023, nearly returning to the levels observed in Q1 2022. This resurgence in asking prices reflects a gradual return of seller confidence to the market.

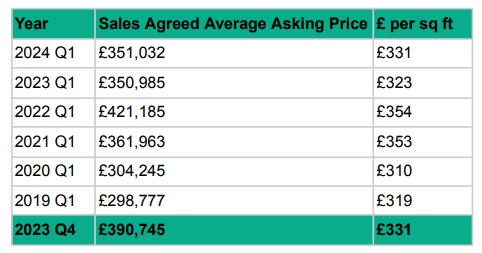

- **Sales Agreed:** Properties with sales agreed in Q1 2024 command an average asking price per square foot that is up 2.48% compared to Q1 2023. While prices are showing signs of improvement, they have yet to reach the peaks witnessed in 2021/2022 before the market shift.

In essence, the Harborne Q1 property market presents a landscape characterised by stability, confidence, and incremental price improvements. By embracing informed decision-making and adapting to evolving market dynamics, stakeholders can navigate the market with resilience and confidence, fostering a vibrant real estate ecosystem within the community.

Contact us now for complimentary analysis specific to you and your Edgbaston home on 0121 5170251 or andy@mchugohomes.co.uk.

Andy McHugo

Director

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link